Rodney Atkinson

It has always been hilarious to listen to those eurofanatics (who have brought much of Europe to its democratic annihilation and economic collapse) warning the Greeks that they are “dangerously close” – as one EU official said – to exit from the very thing which has destroyed them.

We have chronicled the collapse of Greece, Spain and other Mediterranean countries over recent years on this site and pointed to the social disintegration, financial destruction and the break down of health systems, the rise in child malnutrition and the inevitable rise of far left and far right parties as desperate peoples turn – as they did in 1930s Germany – from the buffoonish corporatist “centre parties” and their supranational allies to political extremes. Those extremes were created by so called democrats. Syriza in Greece was created by the Eurozone and its magnificently unconcerned leader, Angela Merkel.

Just as Greece’s debt problems started with its membership of the Euro so its devastating suicide rate took off as austerity was imposed by Euro commissars in 2011. From a recent academic study:

In 30 years, the highest months of suicide in Greece occurred in 2012. The passage of new austerity measures in June 2011 marked the beginning of significant, abrupt and sustained increases in total suicides (+35.7%) and male suicides (+18.5%). …………Suicides by men in Greece also underwent a significant, abrupt and sustained increase in October 2008 when the Greek recession began (+13.1%) and an abrupt but temporary increase in April 2012 following a public suicide committed in response to austerity conditions (+29.7%). Suicides by women in Greece also underwent an abrupt and sustained increase in May 2011 following austerity-related events (+35.8%).

In Greece I know from personal friends that there is after years of social degradation, economic suffering and family bankruptcy also a gnawing psychological suffering which brings discord between friends. As my friend writes:

“The continuous crisis really tears at the nerves. There are no more conversations with friends which do not centre on “the crisis” and we have to be careful that we don’t endanger our friendships as tempers flare and sometimes great gulfs in opinion emerge.”

Similar gulfs would have opened up long before now (and they will soon) between the nations in the Eurozone, between the European Central bank and the IMF, between Germany and France and between the Northern Euro-states and the mediterranean countries.

The IMF has been particularly corrupted by this crisis since its tradition is to apply a formula for debtors which involves sacrifice initially but then a chance to recover by devaluing their currency, promoting exports and inhibiting imports. But this they could not do with any Eurozone country because the Euro fixes an (alien) currency for all members which cannot be freed. All the suffering must be by “internal devaluation” (lower wages, lower prices, lower welfare, lower State spending) which is death to a country with massive internal and external debts like the Greeks.

IMF CORRUPTED

But the IMF has also been nobbled. It was unfortunately George Osborne the British Chancellor of the Exchequer who supported the French eurofanatic and former French cabinet Minister Christine Lagarde as head of the IMF. (It was one of her underlings, Olivier Blanchard, also French, who not long ago attacked British economic policy saying it was a recipe for disaster – just before the UK economy made a dramatic recovery, far healthier than any Euro-zone country!

Lagarde, contradicting all IMF tradition and experience of rescuing indebted countries, acted as a Euro-corporatist interloper in the IMF and went along with the German and European Central bank’s attack on the Greeks whose massive increased debts (at least from 2010) were designed not to save Greece but to – temporarily – save the Euro.

THE EURO AND THE ECB LOST ALL CREDIBILITY

The ECB by imposing those debts on Greece and demanding even more austerity from a country already in a debt deflation spiral has been forced to take on more and more liabilities – as well as forcing other Eurozone countries (many of them scarcely better off than the Greeks) to lend to the Greeks money which they will never be able to repay.

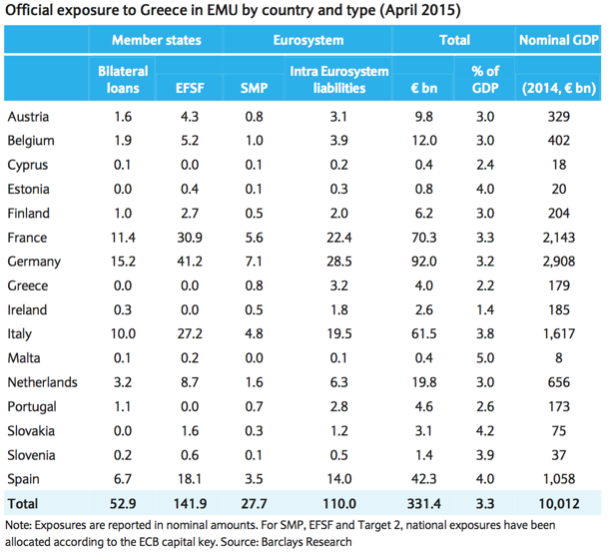

Poor countries like Estonia, Slovakia, Spain, Malta and Italy have exposures of about 4% of GDP each. At the moment these are liabilities not losses and so can be disguised to a certain extent from those countries’ voters! In addition the massive quantitative easing by the ECB is further disguising the true liabilities of Euro member states. But when (not if) Greece defaults these losses will be realised and evident!

A lot of Eurofanatic politicians will be exposed.

The ECB itself could not survive a Greek collapse, having spent Euros 138 billion on rescuing Greek banks and being the lead in exposing its member states to Euro 331 billion of Greek debt – see the table.

The whole Eurozone has a debt to GDP ratio of over 90% and we know from all financial experience that it is not good saying – “but look at Germany and one or two other members who are doing so well with few debts” because it is always the few very bad debts and very bad debtors who cause the collapse of the whole system.

Greece cannot stay in the Eurozone. Its suffering has been great and would be even more catastrophic if it were to remain. Leaving the Euro will be initially painful but with its own currency, much good will from the peoples (not the exploitative Governments) of Europe and elsewhere Greece will head – as it did with Iceland which shunned membership of the EU – towards recovery, a restoration of sovereignty, democracy and that inestimable feeling of national freedom.